In the United States, a foreign trade zone (FTZ) is a geographical area, in (or adjacent to) a United States Port of Entry, where foreign goods can be imported but remain exempt from U.S. Customs territory for the purpose of duties. This allows a foreign trade zone operator to defer, reduce and at times eliminate tariffs, expedite logistics and reduce import fees. This tariff and tax relief is designed to lower the costs of U.S.-based operations engaged in international trade and thereby foster global competitiveness.

Operated by the Port of Moses Lake.

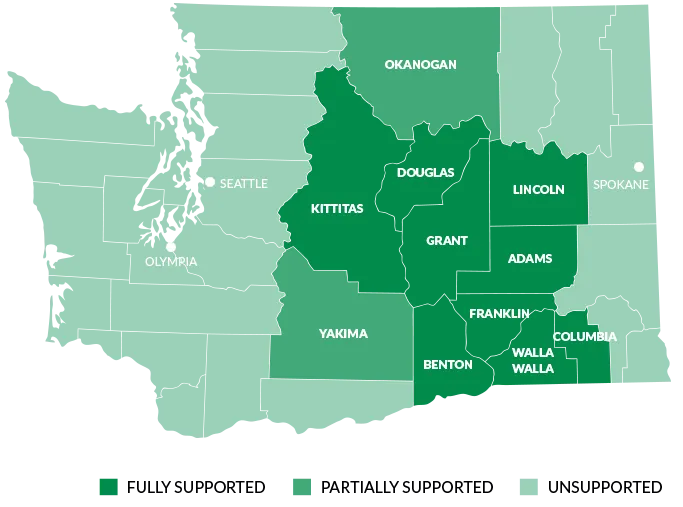

Foreign Trade Zone #203 converted to an Alternate Site Framework (ASF) in 2010, allowing us to support business in the 11 counties shown in the map above. An FTZ can assist with long term and short term company growth as well as enhancing logistics and reducing document processing fees with U.S. Customs.

These questions can assist with determining if an FTZ might benefit your company.

- How much do you spend on duties per year?

- What is the value of your imported merchandise annually?

- Do you re-export, modify, manufacture or re-package your imported goods?

- How many customs entries do you make a year?

- Has your business been affected by supply chain delays at ports of entry?

Foreign Trade Zone #203 is an option to assist Central Washington companies conduct business in a more stable environment. An FTZ can prevent trade disputes from having an overnight impact on your operation. This will allow you and your potential customers to enjoy business as normal in a constantly changing global trade market.

- Spare parts: Spare parts can be held in an FTZ without U.S. Customs duty payment, generating cash flow savings. Obsolete parts can be destroyed in the FTZ without duty payment.

- Temporary removal: Imported goods can be removed from the FTZ for 120 days while under bond for exhibition or repair.

- Damaged, destroyed or waste: Duties can be avoided on defective or damaged goods by inspecting and testing imported goods within an FTZ.

- Quota merchandise: Imported quota merchandise can be warehoused in the FTZ duty free until the next quota period opens.

- Duty reduction or elimination: Subject to FTZB approval, an article can be manipulated or manufactured into a new article with a different tariff classification which can result in a reduction or elimination of customs duties.

- FTZ weekly entry: Entry and Merchandise Processing Fee (MPF) are paid weekly, rather than daily, saving time as well as brokerage fees.

Download free information regarding FTZ #203. Be sure to check back regularly for the latest FTZ #203 news and announcements.